US: Ask your Representative to cosponsor Worker Relief & Credit Reform Act

Exciting news – Rep Gwen Moore will be reintroducing the Worker Relief and Credit Reform (WRCR) Act this Thursday, March 9. Please ask your Representative to sign-on to the WRCR Act right away as an original co-sponsor. You can send a model letter directly to your reps at this link.

The WRCR Act modernizes the Earned Income Tax Credit (EITC), reaching more workers and expanding the definition of work to make unpaid family caregivers and low-income students eligible for EITC for the first time. By recognizing the work of mothers and other unpaid caregivers as well as low-income students and getting money directly into their hands, the WRCR Act is expected to reduce poverty by one-third, especially among women of color, single mothers, survivors of domestic abuse, those with disabilities, older women and more. More about the bill below. Please also let us know if your organization would like to endorse it.

We are also hoping you and others in your networks will be able to join our grassroots delegation in attending the Thursday March 9 press conference in Washington DC announcing the reintroduction of the WRCR Act and help spread the word! 10-10:45am at the House Triangle outside the US Capitol. Your participation will show your visible support for Congresswoman Moore’s efforts to attack poverty.

If you are not able to come, but want to send a message about what the WRCR Act would mean to you as a caregiver or student, please send it to us and we can pass it along. Thank you.

Global Women’s Strike and Women of Color/GWS

215-848-1120 philly@allwomencount.net

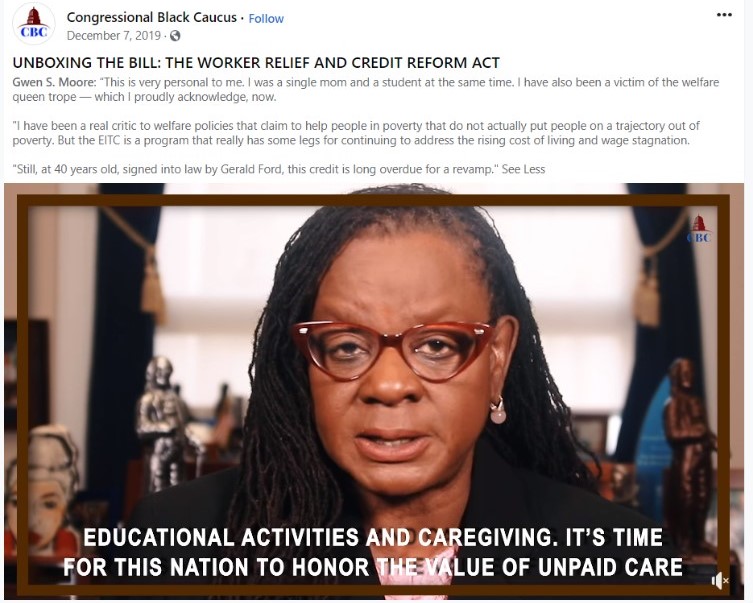

As Rep Gwen Moore (D-WI) and herself once a single mother on welfare, wrote to her colleagues:

Dr. King once said, “the solution to poverty is to abolish it directly.”

The Worker Relief and Credit Reform (WRCR) Act of 2023 puts money back into the pockets of those who need it most. At a time when 40% of Americans cannot meet a $400 emergency expense, and one in seven Americans lives in poverty, the WRCR Act will boldly build on one of our most successful anti-poverty policies, the Earned Income Tax Credit (EITC), to address poverty head on and reduce financial instability.

By modernizing and expanding the EITC, the WRCR Act would benefit nearly half of all Americans (estimated at 161 million by ITEP in 2019); cut the poverty rate by one-third; benefit family caregivers, low income students, and older workers; and provide more financial stability by smoothing income.

Key features of the WRCR Act include:

- More support for more people – phases in the credit more quickly and extends the phase out to benefit more people living in deep poverty and more people in the middle class. Also increases the maximum credit for most people to $4,000 for single filer and $8,000 for married filers.

- Modernizes the definition of work – credits the value of family caregiving (as well as caregiving of cohabitating individuals), and low-income students.

- Expands the age range – decreases the eligibility age so that workers without children are eligible starting at age 18 (instead of 25) and provides credit to working Americans older than 65 years.

- Makes the credit more user-friendly – smooths incomes by allowing for monthly advance payments option for up to 75% of estimated credit. Also, reduces the error rates by decoupling the credit from the size of the family, and boosts taxpayer assistance initiatives including optional consultations, online services, and pilot outreach programs.