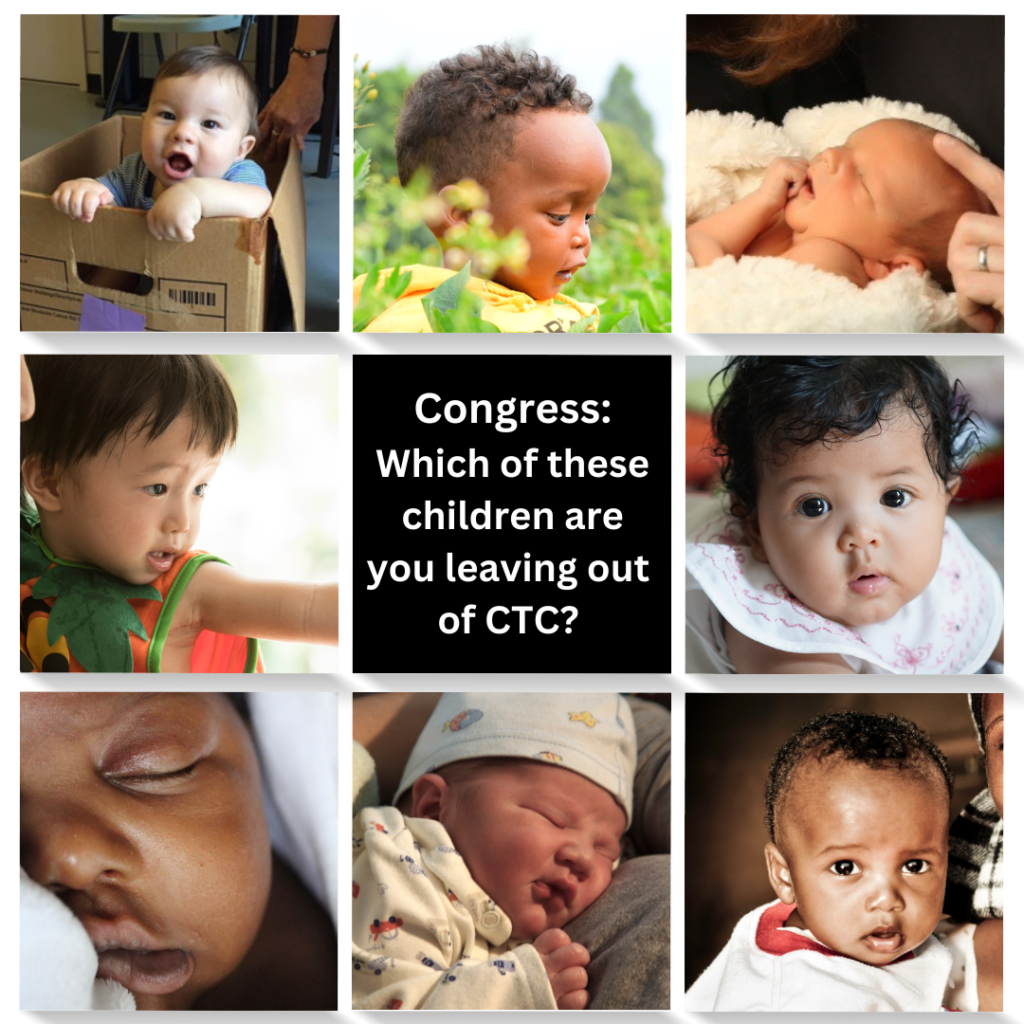

Congress: Don’t exclude the most vulnerable children from the Child Tax Credit!

URGENT! Please ask Congressional leadership and your reps to make critical improvements to the Child Tax Credit (CTC) in the Tax Relief for American Families and Workers Act of 2024, the bi-partisan bill now under consideration.

⚡ Also call and tweet your members of Congress and Congressional leadership, see below

While there are some positive elements in the Tax Relief for American Families and Workers Act of 2024 regarding the Child Tax Credit (CTC), and while we appreciate the efforts to create the bi-partisan Act, the CTC sections of the act urgently need strengthening. While the Act would lift 400,000 children out of poverty, in contrast almost 4 million were lifted out of poverty by the Expanded Child Tax Credit that unfortunately Congress allowed to end. In this replacement CTC, 2 million children from the most impoverished families would get no child tax credit at all. Additionally, 17 million children would not qualify for the maximum credit of $2000 per child because their parents don’t earn enough and there is a mandated waged work requirement. As Congresswoman Gwen Moore pointed out, under this billa single mother with one child would have to do waged work for 70 hours a week to get the maximum CTC (and that’s in addition to her unpaid family caregiving for her children at home).

🎬 WATCH: Rep. Gwen Moore speaking at the US House Ways & Means markup hearing last week

Representative Rosa DeLauro who has championed an expanded CTC for decades says of the proposed legislation: “Corporations get everything they asked for and children got pennies.” See also her press release.

As mothers, grandmothers and other unpaid family caregivers who have been pressing for reinstatement of the expanded CTC and for our caregiving work to be valued and supported, we urge that this legislation be strengthened.

It is urgent that you take action as the Act may be voted on before the end of the month. Please contact your Congressional representatives right away and let them know you want these improvements:

- Make the CTC ‘fully refundable’ – that is covering families including those with income too low to pay taxes. Children in impoverished families should not be penalized.

- No mandated work requirements – mothers & caregivers are already working! What job is more important than raising the next generation? Family caregivers contribute $1.48 trillion each year in unpaid care and domestic work (OXFAM)

- Pay CTC monthly. Monthly payments can help stop families from going into debt; by the time a yearly tax credit is paid, the debt has already accumulated.

- CTC be sent to the mother or other the primary caregiver. 1 in 4 women in the US have suffered domestic violence and need money to protect themselves and their children.

- Be permanent.

- Available to all families including immigrant families with ITIN numbers.

- Not use CTC payments to reduce other benefits including TANF, or garnished.

- Go to families who need it to keep families together, not to foster parents.85% of children are removed by child welfare because of poverty not abuse.

Urgent! Tell Congress: strengthen the CTC in the 2024 Tax Relief legislation so our most impoverished children are not excluded!

⚡ Send your Representative and Senators this letter. You can adapt the letter to best fit what you want to say. Please include a sentence on why the CTC is important to your family, or draw from mothers’ and grandmothers’ testimonies.

⚡ Call your representatives in Congress. Call the Capitol Switchboard to be connected with your Representative and Senators. For the House, call (202) 225-3121. For the Senate, call (202) 224-3121. After you have called your own members of Congress, call Congressional leadership on both sides of the aisle:

| House Democratic Leader Hakeem Jeffries | 202-225-5936 |

| Speaker of the House Mike Johnson | 202-225-4000 |

| Senate Democratic Leader Charles Schumer | 202-224-6542 |

| Senate Republican Leader Mitch McConnell | 202-224-2541 |

⚡ Tweet at Congress. Click to tweet below. You can also tag your own Representative and Senators. Click here for more tweets.

URGENT! @RepJeffries @SpeakerJohnson @SenSchumer @LeaderMcConnell don’t leave the poorest, most vulnerable children out of #ChildTaxCredit. The bipartisan tax bill should be strengthened and not leave out the 2+ million children in families w incomes too low to pay taxes.

Listen to Carolyn Hill from Philadelphia, a grandmother raising three grandchildren, on how the CTC benefited her family. Featured on the City of Philadelphia’s Community Empowerment and Opportunity website. Read and listen to more testimonies from mothers and grandmothers.

Issued by: Care Income Now!; Global Women’s Strike; Women of Color/GWS; Every Mother is a Working Mother Network; Payday Men’s Network. Contact: careincomenow@globalwomenstrike.net 215-848-1120. 323-646-1269